Digital Onboarding in Banking

Even though online banking was first established many years ago, it is now more popular. With the advent of smartphones, the internet and online banking has become more accessible. Everyone should stay at home.

Many people find it beneficial that banks all over the world have their online banking applications. These applications allow customers to access their bank’s website and let them pay their purchases using their smartphones. QR code scanning, digital wallets and online payments are available. These options are not available for tap-to-go credit cards.

People feel more comfortable using non-cash transactions. Usually, delivery is made right in front their homes.

WHAT IS DIGITAL ONBOARDING?

Digital onboarding allows new customers to be introduced to a financial institution’s platform through an automated process. It gives users access to the company’s services, products, facilities and security measures like the growing in demand passwordless authentication. This makes it much easier to complete forms, submit documents in person and make payments over-the-counter. It is crucial for the current global environment. Customers can use this digital onboarding to become familiar with their online banking platform quickly. It provides clear instructions and guidance on every function of the platform, which is especially useful for older customers who aren’t familiar with smartphones and other gadgets.

It takes much less time to complete a bank transaction than it did before. You can now apply online for loans, open an account, deposit money, and transfer money in a matter of minutes.

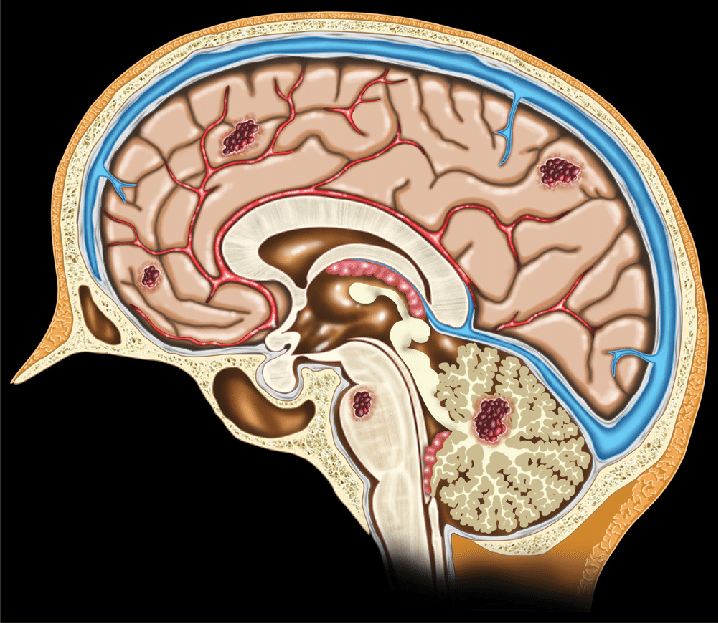

Online banking is risky and open to hackers and breaches. Digital onboarding shows how one institution protects its customers by keeping their money safe and protecting their personal information via passworldess authentication ux and other strict, technologically advanced measures.

To learn more about digital onboarding in banking, you can read this infographic from LoginID.